G. Halsey Wickser, Loan Agent Can Be Fun For Everyone

Table of ContentsWhat Does G. Halsey Wickser, Loan Agent Mean?The smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Talking AboutFacts About G. Halsey Wickser, Loan Agent UncoveredG. Halsey Wickser, Loan Agent - QuestionsExcitement About G. Halsey Wickser, Loan Agent

Home loan brokers aid prospective borrowers discover a lending institution with the best terms and rates to fulfill their monetary requirements.

Just the same, there are benefits and negative aspects to utilizing a mortgage broker. You ought to weigh them meticulously prior to devoting to one. Functioning with a mortgage broker can potentially save you time, initiative, and money. A mortgage broker might have better and extra accessibility to lenders than you have. A broker's rate of interests may not be aligned with your own.

When you meet feasible mortgage brokers, inquire to detail exactly how they'll assist you, all their costs, the loan providers they deal with, and their experience in the business. A home mortgage broker performs as intermediator for an economic establishment that uses fundings that are safeguarded with realty and individuals who wish to purchase property and require a finance to do so.

The Best Strategy To Use For G. Halsey Wickser, Loan Agent

A lender is a banks (or specific) that can provide the funds for the realty deal. In return, the debtor repays the funds plus a set amount of interest over a particular period of time. A lender can be a bank, a cooperative credit union, or other monetary business.

While a home mortgage broker isn't essential to facilitate the transaction, some lenders may only overcome home loan brokers. If the lending institution you favor is amongst those, you'll require to use a mortgage broker. A financing police officer works for a loan provider. They're the person that you'll deal with if you approach a lender for a lending.

The Single Strategy To Use For G. Halsey Wickser, Loan Agent

Then, ask close friends, loved ones, and service associates for recommendations. Take an appearance at on-line evaluations and look for problems. When meeting potential brokers, get a feeling for just how much interest they have in assisting you get the car loan you require. Inquire about their experience, the precise aid that they'll supply, the costs they bill, and how they're paid (by lending institution or consumer). Ask whether they can assist you in specific, provided your details economic circumstances.

They also can steer you far from specific lenders with burdensome settlement terms buried in their home loan agreements. That said, it is beneficial to do some research of your very own prior to meeting a broker. An easy method to promptly get a feeling of the ordinary rates offered for the sort of home loan you're getting is to look rates on the internet.

What Does G. Halsey Wickser, Loan Agent Mean?

Several various types of charges can be involved in taking on a new home mortgage or functioning with a new lending institution. In some cases, home loan brokers might be able to obtain loan providers to forgo some or all of these fees, which can save you hundreds to thousands of dollars.

Some lending institutions might use home buyers the really exact same terms and rates that they use home mortgage brokers (in some cases, even much better). It never ever injures to shop about on your own to see if your broker is truly offering you a lot. As pointed out previously, utilizing a home mortgage calculator is a simple means to reality inspect whether you can discover better options.

If the fee is covered by the lender, you require to be worried regarding whether you'll be guided to a much more expensive loan because the compensation to the broker is extra lucrative. If you pay the cost, number it right into the home mortgage costs prior to making a decision just how great an offer you are obtaining.

Some Ideas on G. Halsey Wickser, Loan Agent You Need To Know

Spend some time speaking to lenders straight to acquire an understanding of which home loans may be readily available to you. When a home loan broker first offers you with deals from lenders, they often make use of the term great belief price quote. This implies that the broker thinks that the offer will certainly symbolize the final regards to the deal.

In some circumstances, the loan provider might change the terms based on your real application, and you could finish up paying a higher rate or additional charges. This is a boosting trend considering that 2008, as some loan providers located that broker-originated mortgages were more probable to go into default than those sourced via straight lending.

The broker will gather information from a specific and go to several lenders in order to locate the best possible car loan for their customer. The broker serves as the loan police officer; they gather the essential info and job with both events to get the finance closed.

Michael Fishman Then & Now!

Michael Fishman Then & Now! Erik von Detten Then & Now!

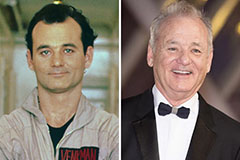

Erik von Detten Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!